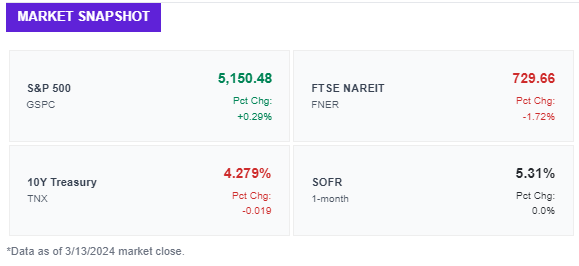

MARKET SNAPSHOT

LOAN ORIGINATIONS

Yardi Matrix Reveals $525 Billion Multifamily Loan Maturity Wave by 2029

A new Yardi Matrix report reveals a staggering $525 billion in multifamily property loans set to mature by 2029, casting a shadow over nearly half of the sector's $1.1 trillion debt portfolio.

Coming due: Over the next five years, more than 58,000 multifamily properties, representing nearly half of the sector's $1.1 trillion in outstanding loans, are on the maturity docket. In the shorter term, nearly $150 billion in loans across 6,800 properties are due by the end of 2025.

Zoom in: Property owners face daunting refinancing conditions, including elevated interest rates, declining property values, and slowing rent growth due to an influx of new units. The burden of maturing debt is unevenly distributed across the US. Atlanta leads with a looming $34.9 billion, followed by Dallas at $26.6 billion, with Denver, Houston, New York City, and Chicago close behind.

On the horizon: Yardi's database reveals that $61.8 billion in loans will mature in 2024, with a peak of $107.3 billion set for 2028. There's a wide range in the timing and source of these loans: nearly half of the debt-fund loans will mature by the end of 2025, and around a quarter of loans from commercial banks and CMBS will do the same. Fannie Mae and Freddie Mac loans make up the bulk of the maturities but with a longer timeline, mostly extending beyond five years.

➥ THE TAKEAWAY

Why it matters: The financial landscape of multifamily is shifting under the pressure of rising interest rates. Fannie Mae and Freddie Mac loans have seen their delinquency rates increase from 0.1% to 0.4% since before the 2022 rate hikes. The jump in CMBS loan delinquencies is even more pronounced, soaring from 1% to 1.8% in just over a year. With Fitch forecasting CMBS delinquencies potentially hitting $1.3 billion—a figure eclipsing pandemic-related losses—the once beloved sector is facing heightened financial stress.